Estimated Taxes Internal Revenue Service

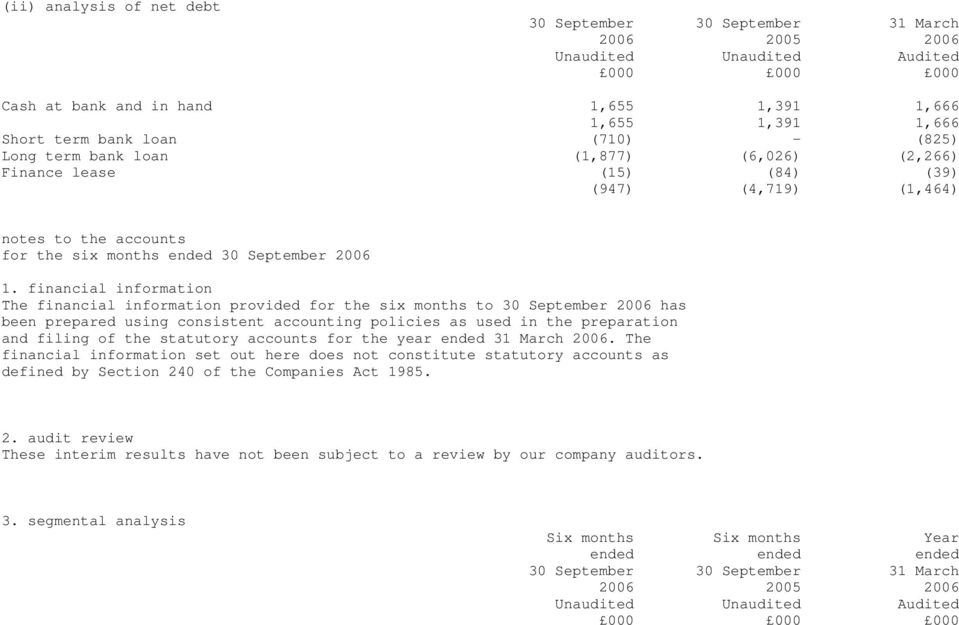

If you pay too much, you can get a refund for the excess amount when you file your return. Quarterly estimated taxes are due on April 15th, June 15th, September 15th, and January 15th. Payments are due the next business day if any of these dates fall on a weekend or holiday.

For businesses filing as a corporation, that threshold is reduced to $500. Taxes must be paid as you earn or receive income during the year, either through withholding or estimated tax payments. If you are in business for yourself, you generally need to make estimated tax payments. Estimated tax is used to pay not only income tax, but other taxes such as self-employment tax and alternative minimum tax. If a taxpayer underpaid their taxes they may have to pay a penalty.

Pay a Penalty

An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan. Refundable tax credits, such as the Earned Income Tax Credit (EITC), can not only reduce your tax bill but turn a bill into a refund. A $700 refundable tax credit would turn your $600 bill into a $100 tax refund.

This applies whether they paid through withholding or through estimated tax payments. A penalty may also apply for late estimated tax payments even if someone is due a refund when they file their tax return. So even if you’ve got absolutely no idea how much you’ll owe for the current year, you can still use the previous year’s numbers to calculate your estimated payments. Even if those payments end up being way off the mark, you won’t owe a penalty. If you don’t pay enough tax through withholding and estimated tax payments, you may be charged a penalty.

Child Tax Credit

However, it also depends on your tax liability and whether or not you received any refundable tax credits. Although there are multiple methods, the easiest way for individuals to pay quarterly estimated taxes is through the IRS website. You can pay directly from a bank account, debit, or credit card, or use Form 1040-ES and mail a check to the appropriate address. To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year. The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates.

If you need some help with your estimated taxes, check out Bench. We’ll get your books in order and take care of federal tax forms (you’ll just need to pay the taxes themselves!). Follow our step-by-step estimated quarterly tax calculator to figure out how much you owe.

Using the Electronic Federal Tax Payment System (EFTPS) is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits (FTDs), installment agreement and estimated tax payments using EFTPS. If it’s easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as you’ve paid enough in by the end of the quarter.

Oh no! I can’t pay this estimated tax bill! What do I do?

Once you have that estimate, subtract any deductions from your estimated income total. You won’t owe an estimated tax penalty if the tax shown on your 2023 return, minus your 2023 withholding, is less than $1,000. We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a more recent return that you filed on or before the due date. The tax shown on the return is your total tax minus your total refundable credits.

This is particularly challenging the first year you make estimated payments, since in subsequent years, you can at least make a guess based on the previous year. If you expect your income this year to be less than last year and you don’t want to pay more taxes than you think you will owe at year end, you can choose to pay 90 percent of your current year tax bill. If the total of your estimated payments and withholding add up to less than 90 percent of what you owe, you may face an underpayment penalty. So you may want to avoid cutting your payments too close to the 90 percent mark to give yourself a safety net. Tax credits are only awarded in certain circumstances, however.

- For 2017, the threshold is an AGI exceeding $150,000, or $75,000 if you have a status of married filing separately for the year.

- The Tax Withholding Estimator does not ask for personally identifiable information, such as name, Social Security number, address and bank account numbers.

- Most types of U.S. source income received by a foreign person are subject to U.S. tax of 30 percent.

- We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

- A financial advisor can help you understand how taxes fit into your overall financial goals.

However, if it turns out that you make way more income this year than the previous one, you’ll end up owing a huge amount in taxes at the end of the year. The IRS requires you to make payments on quarterly estimated taxes when you’re making money from any source that isn’t subject to regular withholding. For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf.

Conforming loans vs non-conforming loans

Use Form 1040-ES to calculate and pay estimated taxes to the federal government. After you complete the form, you can mail it to the IRS with your payment or e-file it online. Corporations must use the Electronic Federal Tax Payment System (EFTPS) to pay estimated taxes.

If you are an employee, your employer probably withholds income tax from your pay. Tax may also be withheld from certain other income — including pensions, bonuses, commissions, and gambling winnings. Based on the tax bracket you enter the calculator will also estimate tax as a percentage of your taxable income. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home.

Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information. Most people who are employees don’t have to worry about estimated taxes because they have taxes withheld from their paychecks. If you’re not an employee, however, then there’s no one withholding taxes from your paycheck for you. If you own a business or receive income from a source other than wages, you’re probably required to make quarterly estimated tax payments.

This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income. If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings. There is a special line on Form W-4 for you to enter the additional amount you want your employer to withhold. Using your income information, we’ll look for any tax credits that will either impact your refund or the amount you owe, as well as deductions to lower your taxable income. Use the IRS Direct Pay option to pay estimated taxes online with the IRS.

You need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated tax for the next quarter. You want to estimate your income as accurately as you can to avoid penalties.

If you know the specific amount of taxes, add as an annual total. If you underpay your estimated taxes, you will likely need to fill out Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts. To get your AGI, first estimate your total income for the year.

Mega Millions jackpot hits $940 million. If you win, here’s the tax bill – CNBC

Mega Millions jackpot hits $940 million. If you win, here’s the tax bill.

Posted: Fri, 28 Jul 2023 07:00:00 GMT [source]

A 20% down payment also allows you to avoid paying private mortgage insurance on your loan. A tax deduction lowers your taxable income, which lowers your tax bill. If you owe $600 in taxes and have a $500 tax credit, your tax liability falls to $100. If you have a $500 credit and a $300 tax bill, you can only reduce your bill to zero.

Here’s how IRS installment plans work, plus some other options for paying a big tax bill. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming How to calculate estimated taxes loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

If you’ve already paid more than what you will owe in taxes, you’ll likely receive a refund. Next, we’ll dive a little deeper to see how much you’ve already paid in taxes this year. For many, this is the amount withheld from their paychecks by an employer. If you need help calculating estimated taxes, you can reference the IRS’s Estimated Tax Worksheet on Form 1040-ES, Estimated Tax for Individuals. Calculate your income tax by multiplying your AGI by your income tax rate. Use Publication 15-T and the applicable tax brackets for this step.

Once you have subtracted deductions from your adjusted gross income, you have your taxable income. If your taxable income is zero, that means you do not owe any income tax. This means that employers withhold money from employee earnings to pay for taxes. These taxes include Social Security tax, income tax, Medicare tax and other state income taxes that benefit W-2 employees. Our team at Founder’s CPA can help you with this, but for now, here are a few things you should know about quarterly estimated taxes. Curious how much you might pay in federal and state taxes this year?